Pensions through time: The power of ongoing financial planning

The rules surrounding pensions have transformed significantly throughout their history, most people will not be aware of the changes that have been made. Understanding the evolution of pension allowances and limits is extremely important throughout your lifetime, not only will it help provide insight into the changing of dynamics for your retirement planning it will most importantly keep you up to date on any opportunities that may arise that could benefit your financial plan hugely.

Why were pensions introduced?

In 1909, the ‘Old Age Pension’ was introduced in the United Kingdom. The main reason for the introduction being that the government began recognising the need to address the financial challenges individuals faced in their retirement years. Initially, pension schemes were limited to certain professions or industries, however with society recognising the increased importance of retirement planning, pension options have grown in line with this.

History of the Lifetime Allowance

Before we get into the history, let’s first just establish what it means. The Lifetime Allowance (LTA) refers to the maximum amount of pension savings an individual can accumulate without incurring additional tax charges when they access their pension.

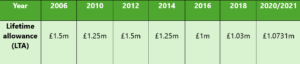

Since the introduction of the Lifetime Allowance for pensions in 2006, limits have increased and decreased over time in line with changes in government policies.

It’s important to note that these changes were made to manage the fiscal impact of pension tax relief and to ensure that pension contributions align with the governments policies at the time. Essentially, the government wants to find the optimal balance between encouraging individuals to save towards their retirement whilst addressing any fiscal concerns.

Lifetime Allowance abolished!

The abolition of the Lifetime Allowance is a massive change in the evolution of pension regulations, creating new avenues of flexibility and opportunity for retirement planning. Prior to the announcement in the Spring 2023 budget announcement, if you wanted to access your pension(s) and were above the current lifetime allowance, you would potentially be subject to an additional tax charge on the excess at between 25% and 55%. As it stands, the lifetime allowance calculation is still completed, but the tax rate is at 0%. The government plan on removing the LTA completely from 24/25.

How will retirement planning be affected?

- Allows for more extensive wealth accumulation.

- Longer term saving looks more attractive, as potential for high tax charges on breaching limit has diminished.

- Simplification – it has reduced the complexity of financial planning and so more focus can be applied on retirement strategies needed to meet your goals and objectives.

Tax year end planning actions

We are fast approaching the end of the 2023/2024 tax year, a time where you can make use of your allowances. In the current tax year, the annual allowance is £60,000, have you used this? Would it be beneficial for your financial plan?

Of course, with all things financial planning, there are many more opportunities that may be suitable for you and your retirement, if you want to find out more, get in touch with the team, we would be more than happy to have a chat.

Thanks for reading & enjoy the journey.